Forex trading investment has gained widespread popularity in recent years, primarily due to its accessibility and potential for profit. Individuals and institutions participate in the foreign exchange market to speculate on currency movements, hedge against risk, and gain exposure to the global economy. If you’re considering entering this dynamic market, it’s essential to understand the fundamentals, strategies, and risks involved. One valuable resource in your trading journey could be forex trading investment Best Islamic Trading, which offers specific insights for traders looking for Islamic-compliant trading options.

What is Forex Trading?

Forex, or foreign exchange, refers to the decentralized global market for the trading of currencies. It is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stock markets, which are closed after trading hours, the forex market operates 24 hours a day, five days a week. This accessibility allows traders from around the world to engage in currency trading at any time, fostering a highly liquid market characterized by rapid price movements.

The Importance of Currency Pairs

In forex trading, currencies are traded in pairs, with one currency being exchanged for another. The first currency in the pair is known as the base currency, while the second is the quote currency. For example, in the EUR/USD pair, the Euro is the base currency, and the US dollar is the quote currency. The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency. Understanding currency pairs is crucial for traders, as it affects how they analyze market trends and execute trades.

Types of Forex Orders

Forex trading involves various types of orders that traders use to enter and exit positions. The most common types are:

- Market Orders: This order is executed immediately at the current market price.

- Limit Orders: This order allows traders to specify a price at which they want to buy or sell a currency pair. The order is only executed if the market reaches that price.

- Stop Orders: A stop order will execute a trade once the market price reaches a specified level, often used to limit losses or protect profits.

- Trailing Stop Orders: This type of order allows traders to set a stop loss that moves with the market price, enabling them to secure profits while allowing for potential upside.

Forex Trading Strategies

Developing a sound trading strategy is critical for success in forex trading. Here are some of the most popular strategies employed by traders:

1. Day Trading

Day trading involves opening and closing positions within the same trading day, aiming to capitalize on short-term market movements. Day traders often use technical analysis and rely on currency charts to identify trends and patterns.

2. Swing Trading

Swing trading focuses on capturing short- to medium-term price movements over several days or weeks. Traders employ both technical and fundamental analysis to identify potential price swings and use stop-loss orders to manage risk.

3. Position Trading

Position traders aim to hold trades for weeks, months, or even years, looking to capitalize on long-term trends. This strategy is less concerned with short-term fluctuations and often relies on fundamental analysis.

Risk Management in Forex Trading

Effective risk management is vital for any successful trader. Here are some key risk management techniques:

- Use of Stop-Loss Orders: Implementing stop-loss orders helps limit potential losses by defining exit points.

- Proper Position Sizing: Determining the size of your trades based on your risk tolerance and account size minimizes the impact of any single loss.

- Diversification: Spreading investments across different currency pairs can reduce risk exposure.

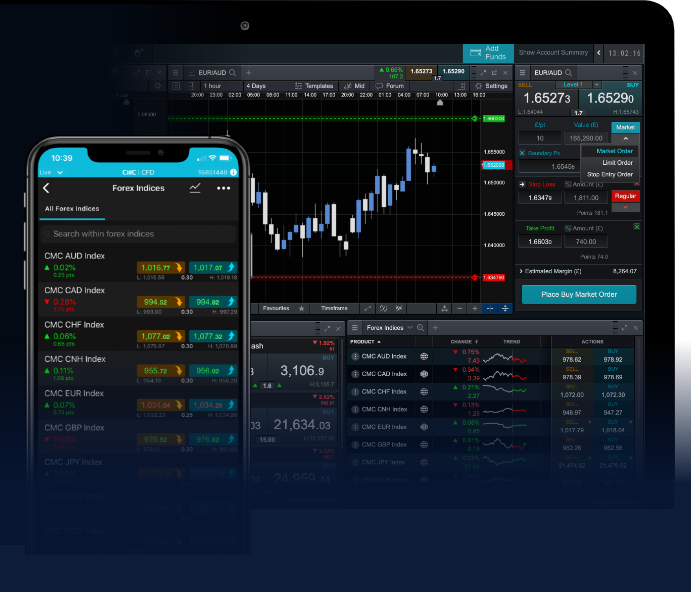

Tools and Platforms for Forex Trading

Traders today have access to a variety of platforms and tools designed to enhance their trading experience. Some popular platforms include MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which offer advanced charting tools, technical indicators, and automated trading features. Additionally, many brokers provide educational resources and analysis to help traders make informed decisions.

The Psychological Aspects of Trading

Trading in the forex market can be emotionally taxing. Traders must cultivate a disciplined mindset, managing their emotions and avoiding impulsive decisions. Developing psychological resilience involves understanding the common biases that influence trading behavior, such as fear and greed. Maintaining a trading journal can also help traders reflect on their trades and improve their strategies over time.

Regulatory Considerations

The forex market is subject to regulations that vary by country. It is essential for traders to choose a regulated broker to ensure the safety of their funds and compliance with fair trading practices. Regulatory bodies, such as the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the US, oversee the operations of forex brokers and help maintain market integrity.

Conclusion

Forex trading investment offers remarkable opportunities for those willing to learn and adapt. By understanding the market structure, developing robust trading strategies, and employing effective risk management techniques, traders can navigate this exciting financial landscape successfully. Remember, continuous education and practice are key components to becoming a proficient forex trader. Whether you’re a beginner or an experienced trader, staying informed and disciplined will significantly enhance your trading journey.