Automatic forex trading has revolutionized how traders approach the foreign exchange market. With advancements in technology and algorithms, automatic forex trading latam-webtrading.com has emerged as a key player in providing traders with the necessary tools to automate their trading processes effectively. This article will delve into the complexities of automatic forex trading, exploring its benefits, strategies, pros and cons, and the systems that support it.

What is Automatic Forex Trading?

Automatic forex trading, often referred to as algorithmic trading or forex robots, involves using computer algorithms to execute trades on the foreign exchange market automatically. Traders can design these algorithms to follow specific strategies and rules, taking emotions out of the equation. By setting parameters for entry and exit points, traders can let the system analyze market conditions and execute trades on their behalf.

The Rise of Automated Trading Systems

The advent of automated trading systems has allowed traders—both beginners and experienced professionals—to capitalize on market opportunities without being glued to their screens. Over the years, advancements in technology have enabled these systems to become more sophisticated, incorporating machine learning and real-time data analysis. The growing accessibility of financial data has also played a crucial role in the rise of automatic trading, allowing traders to fine-tune their strategies based on historical performance and current market trends.

Benefits of Automatic Forex Trading

1. Speed and Efficiency: Automatic trading systems can process vast amounts of data and execute trades in fractions of a second. This speed is essential in the highly volatile forex market, where prices can change rapidly.

2. Emotional Control: Trading can be an emotionally charged activity, leading to irrational decision-making. Automated systems take emotions out of the equation, executing trades based purely on data and predetermined strategies.

3. Backtesting Opportunities: Traders can backtest their strategies using historical market data to gauge their potential effectiveness before deploying them in live trading.

4. 24/7 Trading: Forex markets are open 24 hours a day, five days a week, and automated systems can monitor and execute trades at any time, capturing opportunities that may occur while the trader is asleep.

Strategies for Successful Automatic Forex Trading

To maximize the benefits of automatic forex trading, traders often implement various strategies. Here are a few popular ones:

1. Trend Following

This strategy involves identifying and following prevailing market trends. Automated systems can be programmed to detect upward or downward trends and execute trades that align with the direction of the market.

2. Arbitrage Trading

Arbitrage exploits price discrepancies between different markets or brokers. Automated systems can quickly identify these discrepancies and execute trades to profit from them.

3. Scalping

Scalping is a short-term trading strategy aimed at making numerous small profits throughout the day. Automated systems can execute trades within seconds or minutes, capitalizing on small price movements.

4. Market Making

Market makers provide liquidity to the market by placing buy and sell orders. Automated trading systems can continuously monitor the market, adjusting the spread to capture profits.

Choosing the Right Automatic Trading System

When selecting an automatic trading system, traders should consider various factors to ensure they choose a platform that meets their needs:

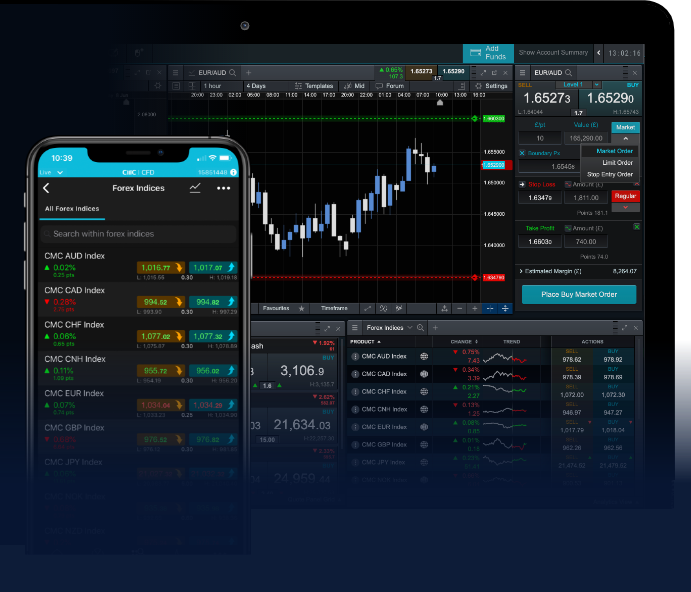

1. User Interface

The user interface should be intuitive and easy to navigate. A complex or confusing system can lead to mistakes and missed opportunities.

2. Customization Options

Traders should look for systems that allow for customization of trading strategies. The more flexibility a platform offers, the better traders can tailor their approach to align with their risk tolerance and market outlook.

3. Performance and Backtesting Results

Before committing to a trading system, it’s important to review its performance history and backtesting results. This information can help traders gauge the potential effectiveness of the system in various market conditions.

4. Support and Community

Having access to customer support and a community of traders can be invaluable. Being part of a community allows traders to share insights, strategies, and experiences, enhancing their overall trading knowledge.

Challenges of Automated Forex Trading

While the advantages of automated trading are significant, there are also challenges to be aware of:

1. Technical Glitches

Like any technology, automated trading systems are not immune to technical glitches. Server downtime or software bugs can lead to losses if traders are not monitoring their systems closely.

2. Over-Optimization

Traders may be tempted to optimize their trading strategies to perform perfectly on historical data. However, this can lead to a concept known as “curve fitting,” where a strategy is so finely tuned that it performs poorly in real market conditions.

3. Market Changes

The forex market is influenced by countless factors, from economic indicators to geopolitical events. Automated systems may fail to adapt swiftly to changing market conditions, leading to potential losses.

Conclusion

Automatic forex trading offers a range of benefits that can help traders capitalize on opportunities in the forex market. By embracing technology and employing sound trading strategies, traders can enhance their performance while minimizing emotional decision-making. However, it is essential to navigate the potential challenges thoughtfully and select a system that aligns with personal trading goals and risk management protocols. As you embark on your path to automatic trading, remember that knowledge, research, and caution are your best allies in the dynamic world of forex trading.