Forex Trading Training: Your Path to Success

Forex trading, also known as foreign exchange trading, is a popular financial market where currency pairs are bought and sold. It is a lucrative opportunity for many, but without proper training and knowledge, the risks can outweigh the rewards. To become a successful trader, you need to equip yourself with the right skills, strategies, and tools. In this article, we will explore essential training tips and strategies for Forex trading, including resources that can enhance your trading journey. One great resource for traders looking for brokers is forex trading training Brokers Argentina, which can help you navigate the myriad of options available.

Understanding the Forex Market

The Forex market is the largest and most liquid financial market in the world, with an average daily trading volume of over $6 trillion. It operates 24 hours a day, five days a week. Traders can take advantage of the market’s high volatility to make profits, but they also need to be aware of the risks involved.

Key Concepts to Master

- Currency Pairs: Understanding how currency pairs work is fundamental. The first currency in a pair is the base currency, while the second is the quote currency. Traders buy or sell pairs based on their predictions regarding the movements in these currencies.

- Pips and Lot Sizes: A pip is the smallest price change in the Forex market, while a lot is the standard unit for trading. Familiarizing yourself with these concepts helps in calculating profits and losses accurately.

- Leverage and Margin: Forex trading often involves leverage, allowing traders to control larger positions with a smaller amount of capital. However, this can amplify both potential gains and losses.

Essential Training Tips for Forex Trading

1. Educate Yourself

Education is the cornerstone of successful trading. Consider investing time in understanding the market’s fundamentals. Various online courses, webinars, and eBooks are available that cover everything from beginner to advanced trading tactics. Look for courses that are reputable and endorsed by expert traders.

2. Develop a Trading Plan

A solid trading plan outlines your trading objectives, risk tolerance, and specific strategies. The plan should include your approach to entry and exit points, risk management techniques, and evaluation metrics. Stick to your plan to avoid emotional trading decisions.

3. Practice with a Demo Account

Most brokers offer demo accounts that simulate real trading environments without risk. Use this opportunity to practice your strategies and get comfortable with the trading platform before trading with real money.

4. Learn Technical and Fundamental Analysis

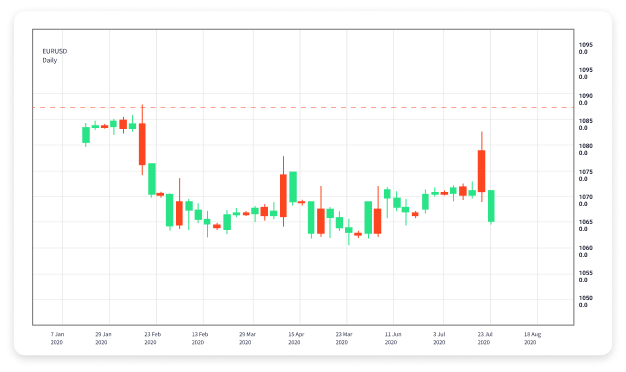

A successful trader should be proficient in both technical and fundamental analysis. Technical analysis involves reading charts and using indicators to predict future price movements. In contrast, fundamental analysis focuses on economic indicators, news, and events that can affect currency values.

5. Manage Your Risks

Risk management is crucial in Forex trading. Never risk more than a small percentage of your trading capital on a single trade. Use stop-loss orders to limit potential losses and protect your profits. A disciplined approach to risk management can prevent significant financial setbacks.

6. Keep a Trading Journal

Documenting your trades can provide insights into your trading behavior and performance. Record details such as entry and exit points, reasons for entering the trade, and overall outcomes. This reflection can help you identify patterns and areas for improvement.

Continuous Learning and Adaptation

The Forex market is dynamic, and trends can change rapidly. It is crucial to stay updated with market news, economic developments, and technological advancements in trading. Follow reputable finance news websites, attend trading workshops, and join trading communities for continuous learning.

Tools and Resources for Forex Traders

A variety of tools can enhance your trading experience. From charting software to economic calendars, having the right resources at your disposal is essential. Here are some useful tools:

- Trading Platforms: Choose a reliable trading platform that offers a user-friendly interface, comprehensive charting tools, and execution speed. MetaTrader 4 and MetaTrader 5 are popular choices among Forex traders.

- Economic Calendars: These help you keep track of upcoming economic events that may influence currency movements. Understanding how these events affect the market can enhance your trading decisions.

- Signal Services: Some traders opt to subscribe to signal services that provide trade recommendations based on technical analysis. While they can be helpful, it’s essential to perform your own analysis before following any signals.

Conclusion

Forex trading is a journey that requires dedication, education, and practice. By following the training tips provided, creating a solid trading plan, managing risk, and continuously learning, you can enhance your trading skills and increase your chances of success in this dynamic market. Remember, trading is not just about making profits; it’s also about becoming a disciplined and informed trader.