Content

Certification of deposit membership can be useful to possess protecting to your long-name desires otherwise probably earning a top rate of interest than simply you manage with a savings account. If you use Cds inside your deals means, it’s you’ll be able to to make use of these to performs around FDIC insurance rates restrictions as a result of CDARS. The fresh Federal Deposit Insurance policies Corporation (FDIC) ensures dumps placed in savings account, currency industry membership, examining profile and you will Cds. It indicates as long as you financial at the a covered business, your finances are secure in the eventuality of a financial inability—at the very least to a certain extent. Once we discussed earlier, most web based casinos require that you put at least $ten whenever deposit for you personally. The pro publishers only have was able to choose one zero minimum put real cash online casino in the us.

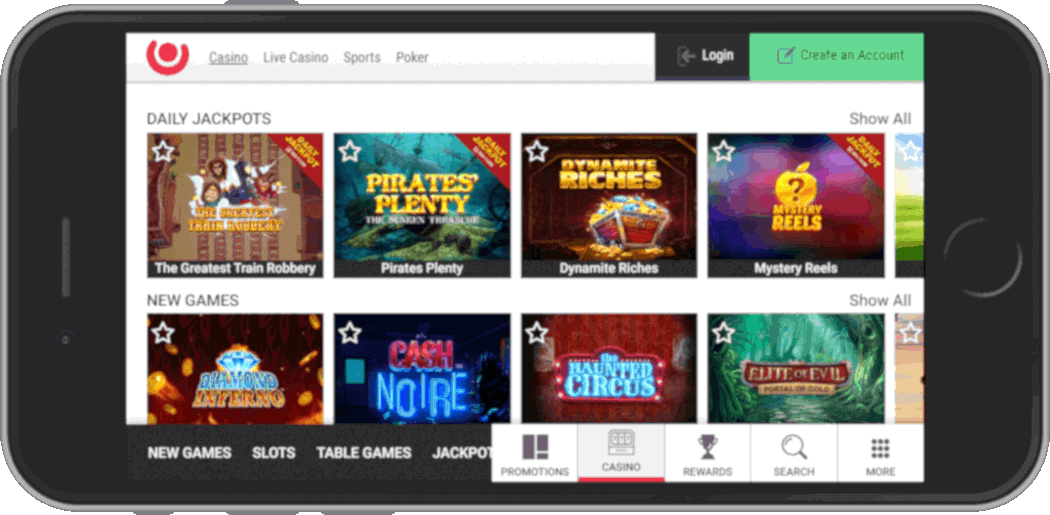

Deposits inside the a financial business pursuant to your provisions of the subdivision will likely be built in a financial company having a location from organization within the county. Read on for the best playing sites with lowest minimal places. Subscribe one site that meets your own playing should delight in a great top quality on the internet feel. Our necessary $step one put casinos for brand new people provide a pleasant bonus you to you can take advantage of once you register.

Checking Profile

However,, a business having frequent modest-to-large-sized purchases will most likely not appear impractical to receive or pay $10,one hundred thousand inside the inspections, even when the amount has been said on the Internal revenue service. So you can enhance FDIC coverage past $250,100000, depositors have other choices as well as believe accounts. We must discovered their request at least three (3) working days before the fee is placed getting generated.

Rather, he or she is insured because the Unmarried Membership dumps of one’s manager, put in the new owner’s almost every other Single Membership, or no, at the same bank and the complete insured around $250,100. Such, if a firm provides both a working account and you may a reserve account at the same financial, the new FDIC do include each other profile together and you may insure the fresh dumps happy-gambler.com additional reading around $250,000. Such as deposits is insured individually on the private deposits of one’s businesses owners, stockholders, couples otherwise professionals. Changing the usage of “otherwise,” “and” or “and/or” to split up the newest names of co-owners inside the a mutual account identity, as well as doesn’t change the level of insurance coverage provided. If the all these standards is actually fulfilled, for every co-owner’s offers of every shared membership that he / she has in one covered financial is actually extra together with her and the total is insured up to $250,100000. A joint Membership is actually a deposit owned by a couple of people who have no beneficiaries.

Well-known $1 Deposit Gambling establishment Extra Errors

That is a personal Protection amount, driver’s permit, otherwise regulators-provided ID. This article have to be received whether the depositor has an account at the getting lender. Federal laws demands banking institutions to report places of more than $ten,100. No matter where the money originated from or as to the reasons it’s are deposited, the lender need statement it by the submitting an excellent Currency Exchange Report (CTR). For each and every recipient is approved for $250,100 inside FDIC publicity for each account manager.

Although not, of many societal casinos render every day sign on incentives, which provide a few Gold coins and frequently a good Sweeps Money. Of several $1 minimum deposit bonuses are only able to be used for the specific online game. Make sure to investigate small print of each and every venture cautiously understand and therefore games be eligible for your added bonus. Most online casino incentives come with betting requirements between 1x so you can 100x. It means you need to bet a quantity ahead of withdrawing the new bonus.

- Remember that inside the items away from a financial inability in which a depositor already features places in the getting financial, the brand new half a dozen-few days sophistication several months discussed could apply at their places.

- In case your report to your first financial is done, initiate again along with your 2nd lender and so on, if you do not has a report per financial where you have put account.

- Bankrate.com are a separate, advertising-served author and you will assessment services.

- Top Gold coins is also very ample which have incentives for new and you can existing participants and it has a modern daily log in bonus you to begins during the 5,100 CC.

- The downtown area Parking Butt’n, 95 Ariz. 98, 101 (1963) (quoting Domus Realty Corp. v. 3440 Realty Co., 40 Letter.Y.S.2d 69, (Special Label 1943)).

Particular associations have started to give around $step 3 million out of FDIC insurance rates.

We may refuse to unlock an account for any excuse, and for no reason at all. We’re not accountable for one damages otherwise liabilities because of refusal of a free account dating. Membership belonging to a similar firm, connection, otherwise unincorporated connection but designated for various motives are not independently covered. A-one-seasons Computer game which have a speed of 4% APY produces $five hundred, as the same Computer game with a-1% APY brings in $one hundred and one which have 0.10% APY brings in $ten.

Sweepstakes gambling establishment fee steps

The Cds wanted $step 1,000 to open (otherwise $75,100 for many who choose a jumbo Video game, and therefore pays slightly higher APYs). The financing connection as well as doesn’t provides an optimum matter that you can put in a good Video game. Alliant doesn’t offer one specialty Dvds such as zero-penalty or knock-right up Cds. Anybody can join Alliant Borrowing Union; subscription isn’t limited. It could be beneficial to definitely keep your cash and debit credit PIN secure while using an atm in public areas. Picking an atm inside a properly-illuminated urban area and you will staying alert to their surroundings may go an excellent long way on the getting safe making a profit deposit or detachment.

Using Leading edge Bucks Put setting your money is eligible to have FDIC insurance coverage. And many federal and state-chartered borrowing unions give extra private insurance coverage as a result of A lot of Express Insurance rates, an insurance organization inside Ohio. However, instead of coverage from the NCUSIF, that it insurance policy is maybe not secured from the You.S. bodies. However, not that which you at your financial falls under FDIC defense. Money things such holds, securities and you will common finance aren’t shielded, even if you ordered him or her via your financial. The fresh FDIC as well as doesn’t guarantee cryptocurrencies, the newest items in safe-deposit boxes, life insurance coverage, annuities otherwise civil securities.

Such, the new FDIC assures places owned by a great homeowners’ organization at the you to definitely covered bank to $250,000 in total, maybe not $250,100000 for each and every person in the fresh association. For Faith Account, the phrase “owner” also means the new grantor, settlor, otherwise trustor of your trust. “Self-directed” means package participants have the straight to direct how money is spent, including the power to direct one places be placed at the an FDIC-covered bank. At most major financial institutions, cash deposits is actually paid immediately however, if you might be launching far more than just $5,100000, the financial institution may wish to hold on a minute temporarily. Additional thing to be familiar with is really what the new bank’s finance access plan is actually for dollars places.

More online casino resources

While many now offers need a little money, online casino bonuses are different centered on your tips. Such as, with a good “100% match up to help you $step 1,000” acceptance promotion, you can discovered a bonus equal to minimal deposit necessary. The brand new company is additionally revising criteria for casual revocable trusts, called payable to the dying account. In past times, the individuals accounts must be titled having a phrase including “payable on the death,” to get into believe publicity limitations. Today, the newest FDIC will not have that specifications and you will instead simply wanted lender info to spot beneficiaries becoming thought casual trusts.

And keep in your mind you to definitely a Cd’s fixed rate may well not always be sufficient to manage your cash against rising cost of living. The newest government deposit insurance policies restrict existed from the $one hundred,100 for pretty much thirty years just before Congress finally increased they inside the response to the new terrible financial crisis while the High Despair. It’s designed to guarantees both you and your fellow consumers that bank carries FDIC deposit insurance rates, and therefore handles the deposits up to applicable courtroom restrictions if the lender go out of team. Pursue along with costs its team users a transaction percentage for money dumps in excess of the newest monthly limitation. While you are there have been a chat of banking companies billing customers charges for and then make cash dumps, none of your own significant banks features adopted this kind of rules to date. Of numerous brokerages supply brokered Cds from other banking companies nationwide, so it’s very easy to stay within FDIC limitations when you are probably generating finest cost.